I have seen posts in the Pag-ibig MP2 Sharing Ideas group on Facebook asking why their total dividends for the year were not as high as they expected.

But first, if you are not familiar about what Modified Pag-ibig 2 (MP2) is and if you’re looking for another way to save money aside from just letting your money sit in your bank account, click this for a summary, but I will write a more detailed post about it one of these days.

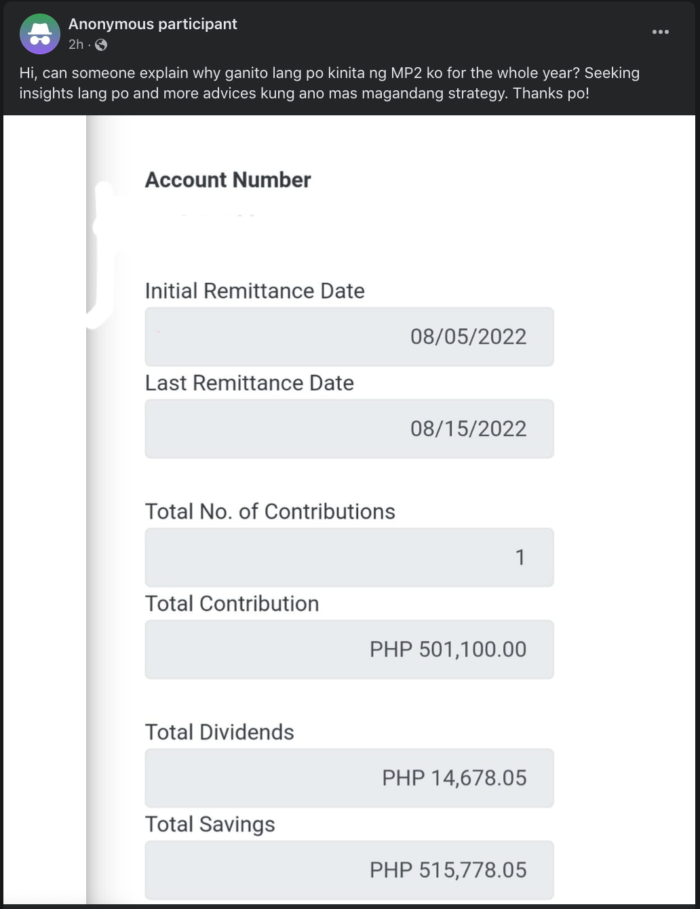

Here’s a post from an anonymous member of the group asking why he received “only” P14,678.05. Let’s start this computation by looking at the initial and last remittance dates. This screenshot says anon has made one deposit amounting to P501,100. (I don’t know why Pag-ibig’s website has a separate “initial” and “last” remittance dates if there is only one remittance. Government websites really are weird. Anyway, let’s just say this anon deposited it on August 15, 2022.)

The first thing to do is to divide the number of months left before the year ends. This will give us the dividend factor. So that you don’t need to make the computation, here they are on the left.

| Month | Number of Months Left | Computation | Dividend Factor |

| January | 12 | 12 divided by 12 | 1 |

| February | 11 | 11 divided by 12 | 0.9166666667 |

| March | 10 | 10 divided by 12 | 0.8333333333 |

| April | 9 | 9 divided by 12 | 0.75 |

| May | 8 | 8 divided by 12 | 0.6666666667 |

| June | 7 | 7 divided by 12 | 0.5833333333 |

| July | 6 | 6 divided by 12 | 0.5 |

| August | 5 | 5 divided by 12 | 0.4166666667 |

| September | 4 | 4 divided by 12 | 0.3333333333 |

| October | 3 | 3 divided by 12 | 0.25 |

| November | 2 | 2 divided by 12 | 0.1666666667 |

| December | 1 | 1 divided by 12 | 0.0833333333 |

Note that I have included here 10 decimal points for the months of February, March, May, June, August, September, November, and December because I just find the final computation more accurate if I do that.

It doesn’t matter what day anon deposited the P501,100 as long as he remitted it in August, the dividend factor is always 0.4166666667. We will multiply these two numbers.

0.4166666667 x 501,100 = 208,791.66668337

This will then be multiplied with the dividend rate on the year of the deposit. Below are the dividend rates from the previous years. The dividend rates are announced by Pag-ibig around February or March of the following year.

| Year | Dividend Rate |

| 2024 | 7.10% |

| 2023 | 7.05% |

| 2022 | 7.03% |

| 2021 | 6.00% |

| 2020 | 6.12% |

| 2019 | 7.23% |

| 2018 | 7.41% |

| 2017 | 8.11% |

| 2016 | 7.43% |

| 2015 | 5.34% |

| 2014 | 4.69% |

| 2013 | 4.58% |

| 2012 | 4.67% |

| 2011 | 4.63% |

The computation therefore is

208,791.66668337 x 7.03% = 14,678.054167841.

This matches the total dividend that anon received for their contribution in the year 2022. So from P501,100, anon now has P515,778.05.

The good thing about this is that the total dividend will be included in the computation for the following year since MP2 is compounding for five years until its maturity (or up to seven years if you choose to).

Let’s say anon made two more contributions for the year 2023. On September 15, a deposit of P50,000 was made and on October 1, a deposit for P500. And let’s say that the dividend rate for 2023 is 7.05%. I am writing this post in September 2023, so we still don’t know what the dividend for the year is, so please remember that this dividend rate is only speculation. (I’ll update this once the dividend rate for 2023 is announce around next year.)

Let’s compute how much anon will receive after those two new deposits.

| Date | Contribution | Dividend Factor | Dividend Rate | Total |

| JAN. 1, 2023 | P515,778.05 | 1 | 7.05% | P36,362.352525 |

| SEPT. 15, 2023 | P50,000.00 | 0.3333333333 | 7.05% | P1,174.9999998825 |

| OCT. 1, 2023 | P500 | 0.0833333333 | 7.05% | P2.9374999988 |

| END OF THE YEAR | P37,540.290024881 |

So by January 1, 2024, anon will have P553,318.34. Note that anon’s account will not mature until August 2027, so their total dividend will still accumulate for three more years.

Here’s a TL;DR:

- Get the dividend factor for the month. Check the table above for this.

- Multiply the dividend factor by the total deposit for each month.

- Multiply this once again with the dividend rate for the year.

- The total for the year will be included in the computation for the following year. Use 1 as the dividend factor.

- Repeat step number 1.

That’s it. I hope you are now more aware about how you compute your total dividends for your Modified Pag-ibig 2 (MP2) accounts. If you have questions, feel free to use the contact form here. Good luck and happy savings!